As technology advances, more and more businesses are using electronic equipment to store sensitive information or run their daily operations. If this equipment is damaged or destroyed, it can have a major impact on your business. That’s why it’s important to have electronic equipment insurance to protect your business in the event of a loss.

This type of insurance can cover a wide range of equipment, including computers, servers, scanners, and other types of electronic devices. It can also cover the costs of repairing or replacing damaged equipment. In some cases, it can even provide coverage for lost data or lost business due to equipment failure.

While electronic equipment insurance is not required by law, it is a wise investment for any business that relies on this type of equipment. If you’re not sure if your business needs this type of coverage, talk to your insurance agent or broker. They can help you assess your risks and determine if this type of insurance is right for you.

Most electronic equipment insurance policies will cover the cost of repairs or replacement if your electronic equipment is damaged by: heft ire looding ower surges Some policies will also cover accidental damage, such as if you drop your laptop and crack the screen. Some companies offer extended warranties that cover additional damage, such as water damage or theft. As with all insurance policies, it’s important to read the fine print to understand what is and isn’t covered.

For example, some policies have a deductible, which is the amount you have to pay before the insurance company will cover the cost of repairs or replacement. If you have expensive electronic equipment, or if you rely on your equipment for your business, it’s worth considering electronic equipment insurance. While it may add an extra cost to your budget, it could save you a lot of money in the long run if your equipment is damaged or stolen.

What Is Electronic Equipment Insurance?

If you have electronic equipment, you may want to think about getting insurance for it. Electronic equipment insurance is a type of insurance that can help protect your valuables from things like damage, theft, and other unexpected events. There are a few different types of electronic equipment insurance, and the coverage can vary depending on the policy.

Some policies may cover things like computers, tablets, smartphones, and other devices. Others may only cover certain types of equipment, like audio or video equipment. Before you purchase a policy, be sure to read the fine print and understand what is and is not covered.

That way, you can be sure you’re getting the coverage you need.

What Does Electronic Equipment Insurance Cover?

Most people have at least some electronic equipment in their homes these days. From computers and laptops to tablets and smartphones, electronic equipment has become a staple in our daily lives. While we may not always think about it, this equipment is vulnerable to damage and theft, just like any other possessions. That’s where electronic equipment insurance comes in.

This type of insurance generally covers loss or damage due to a number of perils, including fire, theft, flood, and vandalism. Some policies also cover accidental damage, such as spilling a drink on your laptop. It’s important to read the fine print of any policy you’re considering, as coverage can vary widely. Generally speaking, electronic equipment insurance is relatively affordable, especially when you consider the replacement cost of some of this equipment.

If you have a home insurance policy, you may already have some coverage for your electronics, but it’s always a good idea to check with your insurer to see what exactly is covered.

What Are The Benefits Of Electronic Equipment Insurance?

Almost everyone has some type of electronic equipment these days, whether it’s a smartphone, laptop, or tablet. And with such expensive devices, it’s important to have them insured in case anything happens to them. Here are some of the benefits of electronic equipment insurance: Protection Against Accidents: No matter how careful you are, accidents can happen. Whether you drop your phone or spill coffee on your laptop, accidents happen.

And if you don’t have insurance, you’ll have to pay for the repairs or replacements out of your own pocket. Protection Against Theft: Unfortunately, electronics are a hot commodity for thieves. If your device is stolen, you’ll be out of luck if you don’t have insurance. Protection Against Natural Disasters: If your home is hit by a flood, tornado, or other natural disasters, your electronics could be damaged.

And if you don’t have insurance, you’ll have to replace them on your own. Affordable Rates: Some people think that insurance is too expensive. However, most policies are very affordable, especially when you consider the protection they offer. Peace of Mind: Knowing that your electronics are protected can give you peace of mind.

And if something does happen, you won’t have to worry about the financial burden of replacing or repairing your devices.

Who Needs Electronic Equipment Insurance?

Almost everyone owns some type of electronic equipment, whether it’s a smartphone, laptop, or desktop computer. And while most people have some type of insurance to protect their belongings, few realize that their insurance may not cover their electronics. That’s where electronic equipment insurance comes in.

This type of insurance can protect your devices from a variety of risks, such as accidental damage, theft, and even power surges. If you own any type of electronic equipment, it’s worth considering electronic equipment insurance to protect your investment.

When Do You Need Electronic Equipment Insurance?

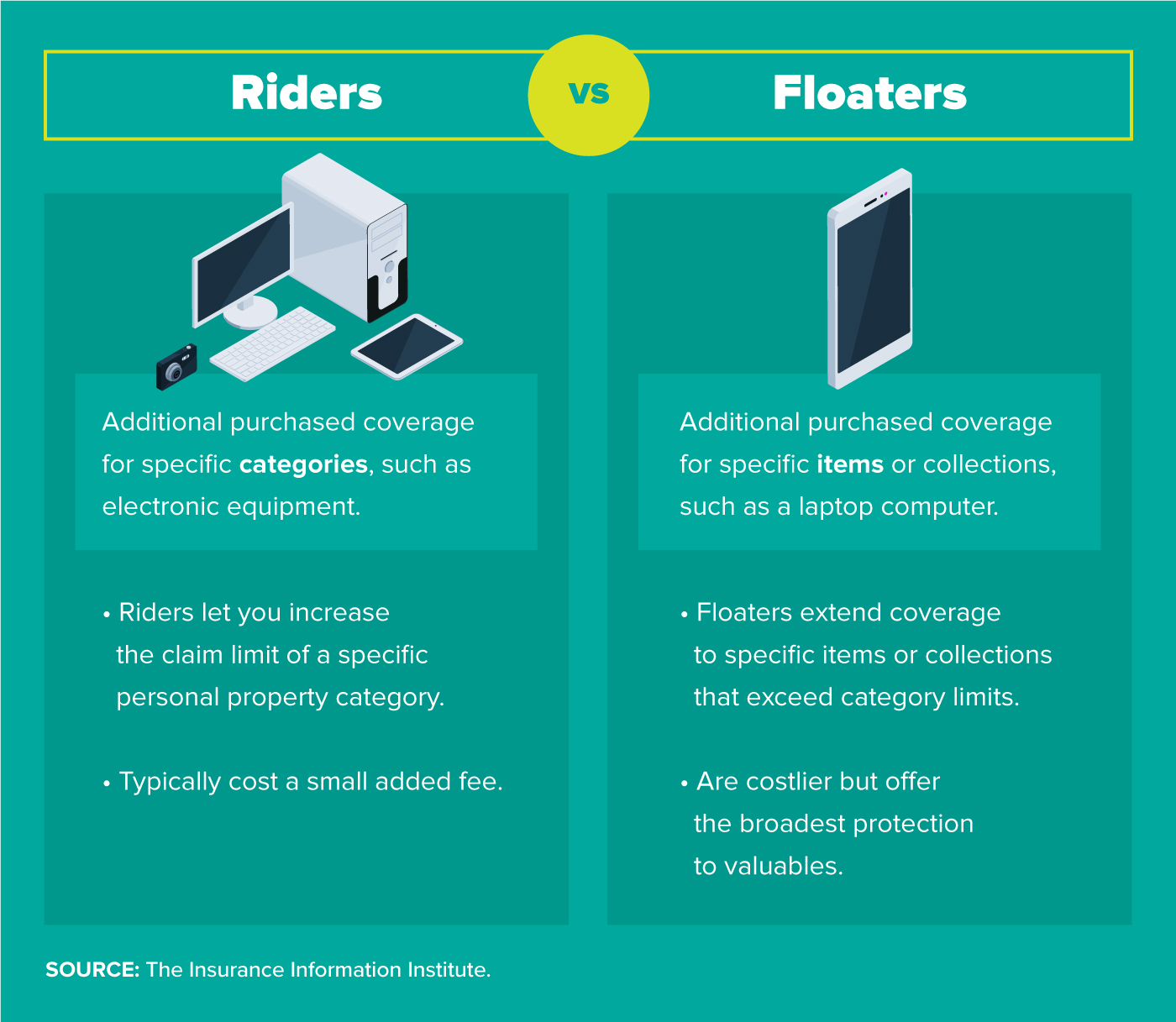

Most people have insurance for their homes and their cars, but many people don’t think about insuring their electronic equipment. If you have a lot of expensive electronic equipment, or if you use your equipment for business, you may want to consider getting insurance. There are a few different types of electronic equipment insurance.

Some policies will cover equipment that is stolen, while others will cover damage from fire, flood, or other disasters. You can also get the insurance that will cover you if your equipment is lost or damaged while you are traveling. Before you purchase insurance, you will need to decide how much coverage you need.

You will also need to decide what type of deductible you are willing to pay. The higher the deductible, the lower the monthly premium will be. Make sure to shop around and compare rates before you purchase a policy.

You can get quotes from several different companies online. Be sure to read the fine print before you purchase a policy so that you understand what is covered and what is not.

How Much Does Electronic Equipment Insurance Cost?

There’s a lot to consider when deciding whether or not to insure your electronics. How much does electronic equipment insurance cost? It depends on a variety of factors, including the type of equipment you have, the value of your equipment, the deductible you choose, and the company you insure with. Generally, electronic equipment insurance costs somewhere between the total value of your equipment.

So, if you have $worth of electronics, you can expect to pay $$ per year to insure them. Of course, the best way to get an accurate quote is to contact a few different insurance companies and get quotes from each one. Be sure to ask about any discounts they offer and compare the coverage to make sure you’re getting the best deal.

How Do You Get Electronic Equipment Insurance?

How Do You Get Electronic Equipment Insurance? You can get insurance for your electronic equipment through a variety of sources. Some companies that manufacture and sell electronics will offer insurance for their products, either through their own policy or through a third-party provider. You can also purchase insurance for your electronics through your homeowners’ insurance policy or a standalone electronics insurance policy.

What Company Offers The Best Electronic Equipment Insurance?

There are a few companies that offer electronic equipment insurance but SquareTrade is the best. They offer insurance for laptops, smartphones, tablets, cameras, and more. You can get coverage for accidental damage, water damage, theft, and more.

Is Electronic Equipment Insurance Worth It?

As the world progresses, so does technology. More and more expensive electronics are becoming a staple in many homes. With the high costs of these devices, it’s no wonder that insurance policies for them are becoming increasingly popular. But is this insurance worth it? On one hand, if you have a very expensive device, the insurance policy could save you a lot of money in the long run if something happens to it.

On the other hand, the monthly insurance premium could add up over time and end up costing you more than if you had just bought a new device outright. It really depends on your personal situation. If you are someone who is very careful with your belongings and have a history of not breaking or losing things, then you probably don’t need insurance. However, if you are accident-prone or have children who are known to break things, insurance may be a good idea.

At the end of the day, it’s up to you to decide whether or not electronic equipment insurance is worth it. Just make sure to do your research and weigh all the pros and cons before making a decision.

Do I Need Electronic Equipment Insurance?

Most people don’t realize that their home insurance policy doesn’t cover their electronic equipment. A standard home insurance policy covers damage from fire, smoke, wind, and hail, but it doesn’t cover damage from water or theft. That’s why you need to ask your agent about adding an endorsement to your policy to cover your electronics. If you have a home office, you probably have a lot of expensive equipment, including a computer, printer, fax machine, and more.

If any of this equipment is damaged, you could be out a lot of money. An endorsement to your home insurance policy will cover the cost to repair or replace your equipment. If you have a home entertainment system, you need to make sure it’s covered, too. Many people have big-screen TVs, surround sound systems, and game consoles.

If any of this equipment is damaged, you could be out hundreds or even thousands of dollars. An endorsement to your home insurance policy will cover the cost to repair or replace your equipment. You should also consider insuring your portable electronic equipment, such as your laptop, smartphone, and tablet. If you lose your laptop or your tablet is stolen, you could be out of a lot of money.

And if you have to replace your smartphone, you’ll probably have to pay a hefty deductible. An endorsement to your home insurance policy will cover the cost to repair or replace your portable electronic equipment. If you have any questions about whether or not you need electronic equipment insurance, talk to your agent. They can help you determine the best way to protect your investment.

What Happens If I Don’t Have Electronic Equipment Insurance?

If you don’t have insurance for your electronic equipment, you are at risk of having to pay for repairs or replacements out of your own pocket if something happens to them. While some people may be able to afford this, others may not be able to and could be left without their essential devices. Not having insurance can also cause problems if you need to make a claim on your homeowner’s insurance policy, as any claims for electronics will likely be excluded.

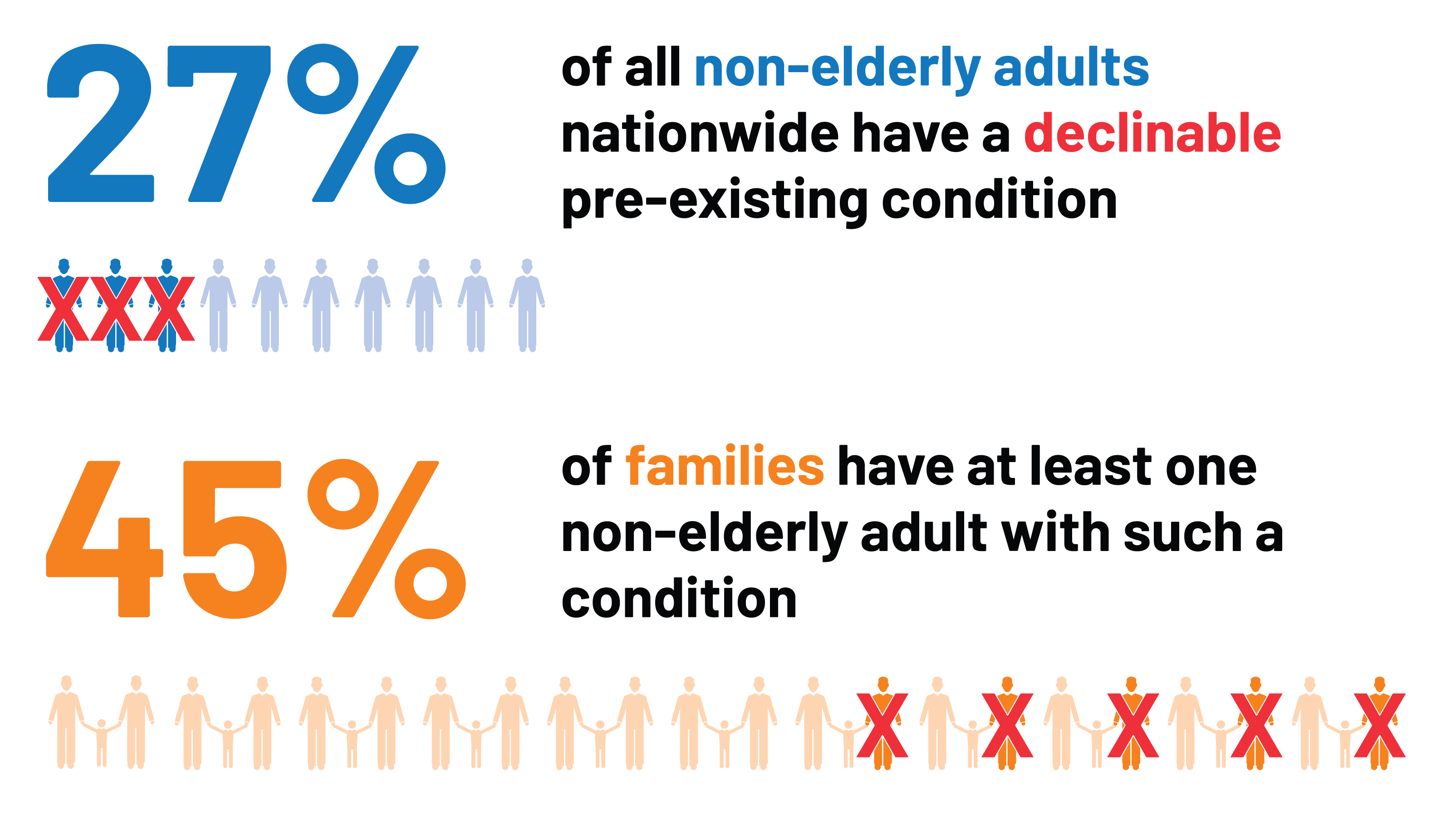

Can I Get Electronic Equipment Insurance If I Have A Pre-existing Condition?

If you have a pre-existing condition, you may still be able to get electronic equipment insurance. This will depend on the insurer, the type of pre-existing condition, and other factors. It’s important to shop around and compare policies to find the right coverage for you.

What Is The Waiting Period For Electronic Equipment Insurance?

There is no waiting period for electronic equipment insurance. You can start using your coverage as soon as you purchase your policy.

Conclusion

Electronic equipment insurance typically covers computers, phones, and other electronic devices against loss, damage, or theft. The coverage may also extend to include data recovery in the event of an equipment failure. Most policies have a limit on the amount that will be paid out for any one claim, so it’s important to know what your limit is before you purchase a policy.

Leave a Reply