Computers and electronics are important parts of our daily lives. We rely on them for work, school, and entertainment. When something goes wrong with our computers or electronics, it can be frustrating and expensive to fix.

Insurance for computers and electronics helps protect us from the high cost of repairs and replacements. It can also cover data recovery in the event of a hardware failure. Whether you have a desktop, laptop, tablet, or smartphone, there is an insurance policy that can help protect your investment.

In today’s world, our lives revolve around technology. Our work, our entertainment, and our social lives all take place on computers and other electronic devices. That’s why it’s so important to have insurance for your computers and electronics.

accidents happen, and when they do, you want to be sure that you’re covered. Insurance for computers and electronics can protect you from loss, damage, or theft. It can also help you recover from data loss or a system crash.

With so much of our lives on these devices, it’s essential to have the peace of mind that comes with knowing you’re protected. Insurance for computers and electronics can give you that peace of mind.

What Is Insurance For Computers And Electronics?

Computers and electronic devices are expensive, and they are often subject to damage or theft. Insurance can protect your investment and give you peace of mind. There are a few different types of insurance for computers and electronics. The most common is manufacturer’s insurance, which is offered by the company that made your device.

This type of insurance typically covers defects in materials or workmanship. It may also cover damage from accidents, such as drops or spills. Another type of insurance is retailer’s insurance, which is offered by the store where you purchased your device. This type of insurance typically covers accidental damage, such as drops or spills.

It may also cover theft. There are also insurance policies that you can purchase from insurance companies. These policies typically cover accidental damage, theft, and loss. They may also cover other risks, such as fire or flood.

When you are choosing an insurance policy, it is important to read the fine print and understand the coverage. Make sure you know what is covered, and what is not. Otherwise, you could end up being surprised when you make a claim.

What Does Insurance For Computers And Electronics Cover?

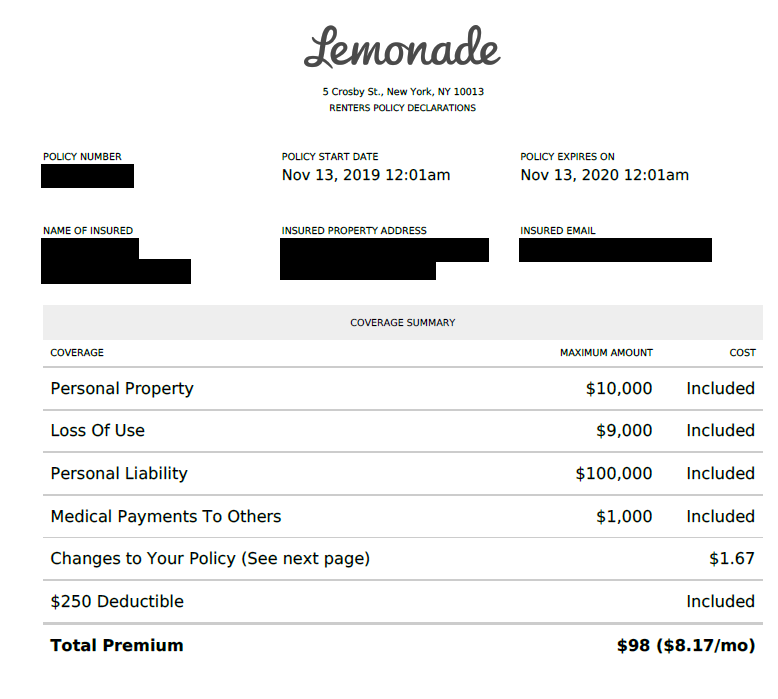

If your computer or electronic device is damaged, stolen, or experiences a malfunction, insurance can help cover the cost of repairs or replacement. Some policies also cover data recovery in the event of a system crash. Before purchasing a policy, it’s important to understand what is and isn’t covered. Most insurance policies for computers and electronics have a deductible, which is the amount you’ll have to pay out of pocket before the insurance company begins to pay.

Deductibles can range from $to $ and sometimes even more for highnd devices. Coverage limits are also important to consider. This is the maximum amount the insurance company will pay for repairs or replacement. Some policies have pertem limits, while others have an overall limit for all covered devices.

It’s also important to read the fine print and understand what is considered to be a covered incident. Some policies only cover accidental damage, while others may also cover theft, fire, or natural disasters. When shopping for an insurance policy, be sure to compare prices and coverage levels to find the best protection for your needs.

What Is The Cost Of Insurance For Computers And Electronics?

Most people don’t know the cost of insurance for computers and electronics until they need it. Then, it’s often too late. Computers and other electronic devices are susceptible to damage from a variety of sources, including power surges, firmware corruption, natural disasters, and physical damage.

And, when these devices break, the cost to repair or replace them can be significant. That’s where insurance comes in. Insurance for computers and electronics can help cover the cost of repairs or replacement if your devices are damaged.

The cost of insurance varies depending on the type of policy you choose and the value of your devices, but it can be a worthwhile investment to protect your investment.

How Does Insurance For Computers And Electronics Work?

There’s a lot of misunderstanding about insurance for computers and electronics. Some people think that it’s a waste of money, while others believe that it’s essential. So, how does insurance for computers and electronics work? Generally, insurance for computers and electronics covers three main areas: loss, theft, and damage. Loss and theft coverages are pretty self-explanatory.

If your computer or electronic device is lost or stolen, you can make a claim with your insurance company and they will reimburse you for the cost of the item. Damage coverage is a little more complex. It covers things like water damage, electrical surges, and mechanical breakdowns. Basically, if your computer or electronic device is damaged and it’s not your fault, you can make a claim with your insurance company and they will reimburse you for the cost of repairs.

There are a few things to keep in mind when it comes to insurance for computers and electronics. First, you typically have to pay a deductible before your insurance company will reimburse you for any losses. Second, there may be limits on how much your insurance company will pay out for each type of loss. For example, they may only cover up to $for theft and $for damage.

Before you purchase insurance for computers and electronics, make sure to do your research and understand what coverage you need. It’s also a good idea to get quotes from a few different insurance companies to compare prices.

What Are The Benefits Of Insurance For Computers And Electronics?

No one likes dealing with damaged electronics, whether it’s a cracked screen on your new iPhone or a waterlogged laptop. Fortunately, insurance can help cover the cost of repairs or replacement if your devices are accidentally damaged. Here are a few benefits of insurance for computers and electronics: Covers Accidental Damage: Most electronics insurance policies cover accidental damage, meaning you won’t have to pay out of pocket if you drop and crack your iPhone screen or spill coffee on your laptop. Protects Against theft: If your device is ever stolen, insurance can help cover the cost of replacement.

This can be especially helpful if you have a high-end device like a MacBook Pro or an iPad Pro. Covers mechanical and electrical failures: Even the best designed devices can have issues. If your computer crashes or your phone stops working, insurance can help cover repair or replacement costs. Flexible coverage: You can usually choose how much coverage you need, whether it’s for a single device or multiple devices.

And, you can often add or remove devices from your policy as needed. Affordable protection: While the cost of electronics can add up, insurance is usually surprisingly affordable. In many cases, it can be as low as a few dollars per month. If you have expensive electronics, insurance can give you peace of mind knowing that you’re covered in case of accidental damage, theft, or mechanical failures.

What Are The Limitations Of Insurance For Computers And Electronics?

While insurance can help mitigate the cost of repairing or replacing damaged computer equipment, there are several limitations to what insurance will cover. For example, insurance generally will not cover intentional damage, meaning damage that was done on purpose. Additionally, most policies have a deductible, which is the amount of money that the policyholder is responsible for paying out of pocket before the insurance company will cover the remaining costs. Furthermore, each policy has its own exclusions, meaning there are certain types of damage that are not covered by the policy.

For example, many policies exclude damage caused by natural disasters, such as floods or earthquakes. Additionally, policies often exclude damage caused by power surges, as this is considered to be a preventable issue. Finally, it is important to keep in mind that insurance will not cover the cost of lost data or lost productivity. While insurance can help offset the cost of repairing or replacing physical equipment, it cannot replace lost data or time.

How Do I File A Claim With Insurance For Computers And Electronics?

Most insurance policies have a section that covers computers and other electronics. The first step is to find your policy and read through the coverage. It will state what is covered and how to file a claim.

The next step is to gather receipts and proof of ownership for the items you are claiming. You will also need to document the damage or loss. Once you have all the required information, you can contact your insurance company to start the claims process.

What Is The Claims Process For Insurance For Computers And Electronics?

If you have insurance for your computer or electronic device, the claims process is relatively simple. You will need to file a claim with your insurance company and provide proof of the damages. The insurance company will then determine if your claim is covered and reimburse you for the damages.

How Long Does It Take To Get A Claim Paid With Insurance For Computers And Electronics?

There is no one answer to this question as it varies depending on the insurance company and the type of claim being made. However, in general, it usually takes around days for a claim to be processed and paid out. This can be quicker if the insurance company has a fast-track process in place for certain types of claims, such as those for lost or stolen items.

What Are The Payment Options For Insurance For Computers And Electronics?

When it comes to insurance for computers and electronics, there are a few different payment options available. You can choose to pay for your insurance monthly, quarterly, or yearly. You can also choose to pay for your insurance in full at the time of purchase, or you can choose to pay only for the coverage you need at the time.

No matter what your budget is, there is an insurance payment option out there for you.

How Do I Cancel Insurance For Computers And Electronics?

If your homeowners or renters insurance policy covers your personal belongings, you may not need a separate insurance policy for your computers and electronics. However, if you want coverage for electronics that goes above and beyond the coverage provided by your homeowners or renters insurance policy, you may want to purchase a separate policy. To cancel your insurance policy for computers and electronics, contact your insurance company and request a cancellation form. Once you have completed the form, mail or fax it back to your insurance company.

Be sure to keep a copy of the form for your records.

What Is The Cancellation Policy For Insurance For Computers And Electronics?

The Cancellation policy for Insurance for Computers and Electronics is as follows: If you cancel within the first days of coverage, you will receive a full refund. If you cancel after the first days, you will be refunded on a prorated basis, less any claims paid.

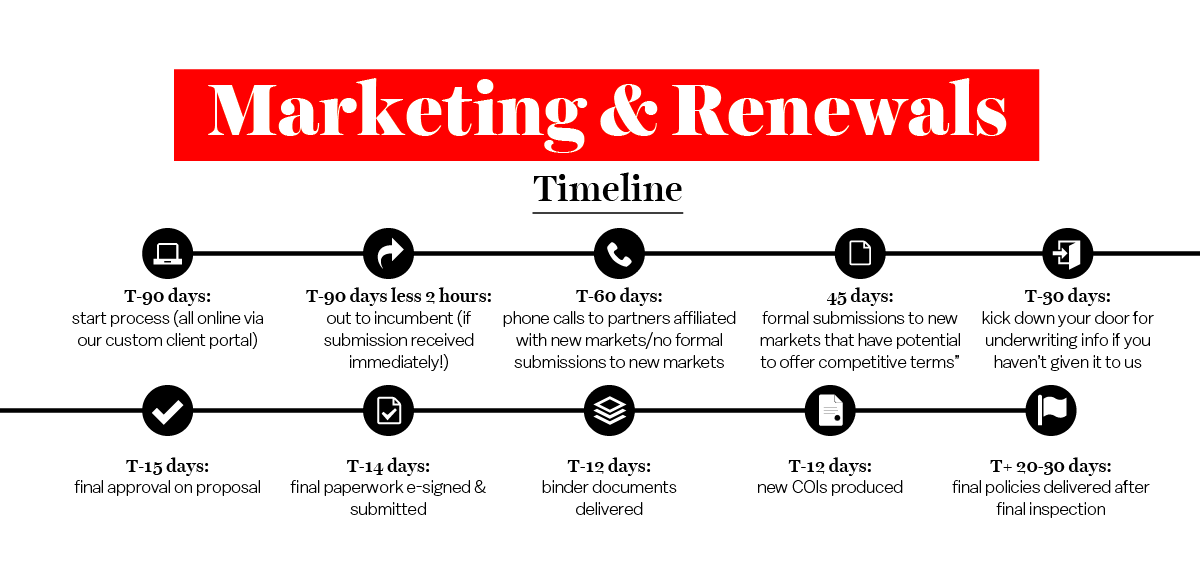

How Do I Renew Insurance For Computers And Electronics?

It is always a good idea to have your computers and electronics insured in case something goes wrong. The first step is to find a reliable insurance provider. Once you have found a provider, you will need to fill out an application and pay the required fee.

Most insurance providers will require you to have your computers and electronics serviced on a regular basis. This will help to ensure that your devices are covered in case of any unforeseen accidents or problems. When it is time to renew your insurance, you will need to update your information with the provider.

This includes any changes to your devices or their usage. You will also need to pay the renewal fee. By following these steps, you can be sure that your computers and electronics are always protected.

What Is The Renewal Process For Insurance For Computers And Electronics?

The insurance industry offers plenty of options when it comes to insuring your computers and electronics. However, when it comes time to renew your policy, you might be wondering what the process entails. Generally speaking, the renewal process for insurance for computers and electronics is fairly straightforward.

You’ll simply need to contact your insurance company and request a new policy. Be sure to have your most recent insurance declarations page on hand, as well as any other relevant documents, such as a list of your covered devices. You’ll also need to provide your payment information so that your new policy can be processed.

In some cases, you may be able to renew your insurance policy online. However, it’s always best to contact your insurance company directly to be sure that you’re getting the most accurate information and the best possible rate.

Conclusion

Ensure your computers and electronics are against power surges, damages, and theft. Get insurance for as low as $a month. Protect your devices now and insure against future damages .

Leave a Reply