Technology has become a staple in our everyday lives. We use it for work, school, and entertainment. And, as we become more reliant on electronics, we need to make sure they are protected. Best Electronics Insurance is a comprehensive protection plan for all your electronics.

It covers accidental damage, theft, loss, and malfunction. So, whether you drop your laptop or your phone is stolen, you’re covered. With Best Electronics Insurance, you can relax and enjoy your electronics without worry. And, in the event something does happen, you can rest assured knowing you’re protected.

It is always a good idea to have insurance for your electronics. After all, your electronics are some of the most expensive items that you own. Best Electronics Insurance is a great way to protect your investment. This insurance company offers a variety of plans to fit your needs.

They have insurance for individual items, such as your computer, or for your entire home office. They also have plans that cover accidental damage, theft, and even natural disasters. Best Electronics Insurance is affordable and easy to use. Their customer service is friendly and helpful.

They make it easy to file a claim, and they have a fast turnaround time. Overall, Best Electronics Insurance is a great choice for anyone who wants to insure their expensive electronics. They offer comprehensive coverage, great customer service, and affordable rates.

What Is The Best Insurance For Electronics?

Your electronics are some of the most important and expensive items that you own, so it’s important to make sure they’re properly protected in case of an accident, theft, or natural disaster. The best insurance for electronics will cover the full replacement value of your devices, without any deductibles or coinsurance, and will provide worldwide coverage. It should also include coverage for accidental damage, water damage, and theft. You can find this type of comprehensive coverage from a variety of insurers, both online and offline.

What Coverages Are Available For Electronics Insurance?

Most people have some type of insurance for their homes and automobiles, but what about their electronics? Cell phones, laptops, tablets, and other electronics are often not covered under a standard home insurance policy. Here’s a look at what coverages are available for electronics insurance. Most home insurance policies will not cover loss or damage to electronics, with a few exceptions.

If your electronics are damaged in a fire, for example, your home insurance policy will likely cover the cost of repairs or replacement. Some home insurance policies also offer limited coverage for theft of electronics, but this coverage is often subject to a deductible. There are a few insurance companies that offer standalone insurance policies for electronics.

These policies typically cover loss, damage, and theft, and can be customized to cover specific items or types of electronics. Some stand-alone policies also cover accidental damage, such as liquid damage to a cell phone or a cracked screen on a laptop. If you have a home office, you may be able to add an endorsement to your home insurance policy that provides coverage for business equipment, including computers and other electronics.

This coverage is generally quite limited, however, and may not cover all types of damage. Whether you have a home office or not, you may be able to purchase a rider to your homeowner’s insurance policy that provides limited coverage for electronics. This type of rider is usually quite inexpensive and can be a good option if you only have a few items that you want to insure.

If you travel frequently with your electronics, you may want to consider purchasing travel insurance that includes coverage for loss or damage to your gadgets. Some credit card companies also offer this type of coverage, so be sure to check with your card issuer to see what’s available. No matter what type of electronics you own, there’s a good chance that you can find insurance coverage to protect them.

Take the time to compare policies and coverage options to find the right policy for your needs.

What Are Some Of The Best Companies That Offer Electronics Insurance?

There are a few different companies that come to mind when you are looking for the best companies that offer electronics insurance. These companies are SquareTrade, Best Buy, and Target. All three of these companies have different prices for their insurance, but all three of them will give you the coverage that you need for your electronics. SquareTrade is going to be the cheapest option out of the three, but they will also give you the best coverage.

Best Buy is going to be a little bit more expensive, but they will also give you a little bit more coverage. Target is going to be the most expensive option, but they will give you the most coverage. All three of these companies are going to give you different options when it comes to coverage, so you need to decide which one is going to be the best for you.

How Much Does Electronics Insurance Cost?

The cost of electronics insurance varies depending on the type and value of electronics you insure and the length of the insurance policy. You can expect to pay around $ to $ per month for a basic policy that covers laptops, smartphones, and other small electronics. A more comprehensive policy that includes coverage for gaming consoles, TVs, and home office equipment may cost $to $ per month.

How Does Electronics Insurance Work?

If you have ever lost a cell phone, you know how expensive and frustrating it can be. Electronics insurance can help alleviate the financial stress that comes with replacing a lost, stolen, or damaged device. Here’s how it works. Most electronic insurance policies have a monthly premium that is generally lower than your cell phone bill.

For example, Verizon’s insurance plan for smartphones costs $per month per phone. In exchange for this monthly fee, you are covered for up to two claims per year with a $deductible per claim. So, if you lose your phone and it costs $to replace, you would only have to pay the $deductible. Of course, there are some limitations to electronics insurance.

For example, most plans will not cover damage that is a result of negligence (e.g., dropping your phone in a puddle). Additionally, many insurance companies have a limit on the amount they will pay to replace a lost or stolen device.

So, if you have a relatively new and expensive phone, it may only be partially covered by your insurance policy. Nonetheless, electronics insurance can be a valuable way to protect your devices and your wallet in the event of loss, theft, or damage.

What Are The Benefits Of Having Electronics Insurance?

When it comes to electronics insurance, there are many benefits that you can enjoy. For starters, it gives you peace of mind of knowing that your devices are protected in the event of an accident or theft. This can be especially valuable if you have expensive devices such as smartphones or laptops.

When it comes to electronics insurance, there are many benefits that you can enjoy. For starters, it gives you peace of mind of knowing that your devices are protected in the event of an accident or theft. This can be especially valuable if you have expensive devices such as smartphones or laptops.In addition, electronics insurance can provide you with replacement coverage in the event that your device is lost or stolen. This can be a lifesaver if you rely on your devices for work or school. And if you have to file a claim, most insurance companies have customer service to help you through the process.

Finally, electronics insurance can give you discounts on your devices. Many insurance companies offer discounts for insuring multiple devices or for signing up for a long-term policy. So if you’re looking for ways to save on your electronics, insurance may be the way to go.

What Should I Look For In An Electronics Insurance Policy?

When it comes to insuring your electronics, you want to make sure you’re getting the best possible coverage. Here are a few things to look for in an insurance policy: overage for Accidental Damage: Many policies will only cover damages that are caused by natural disasters or theft. However, accidental damage is one of the most common ways that electronics are damaged. Make sure your policy covers accidental damage so you’re fully protected.

Replacement Cost Coverage: Some policies will only cover the depreciated value of your electronics. This means you could end up being out of pocket if you need to replace your item. Make sure you have replacement cost coverage so you can replace your electronics without any financial burden. Extended Warranty Coverage: Many electronics come with an extended warranty from the manufacturer.

However, these warranties often don’t cover accidental damage or wear and tear. Look for a policy that will cover these things so you can extend the life of your electronics. ustomer Service: When you have an issue with your electronics, you want to be able to get help right away. Make sure the company you’re working with has customer service so you can get the help you need when you need it.

What Types Of Electronics Are Covered By Insurance?

It’s a good idea to have insurance for your electronics, especially if you have expensive items. Most policies will cover damage from accidents, fires, and floods. They will also usually cover theft, as long as you have proof that the item was stolen.

Some policies will also cover electronic items that are damaged while in transit.

What Is Not Covered By Electronics Insurance?

There are plenty of things your electronics insurance policy probably won’t cover. Water damage, for example, is almost never covered unless it’s caused by a burst pipe or another covered peril. theft is also not typically covered unless it’s due to a break or another type of forced entry.

Most policies also have a maximum limit for each item, so if you have a particularly expensive piece of electronics, it might not be fully covered. And there may be a deductible or an amount you have to pay out of pocket before the insurance company kicks in. It’s always a good idea to read your policy carefully so you know exactly what is and isn’t covered.

That way, you can be sure to get the coverage you need and avoid any unpleasant surprises down the road.

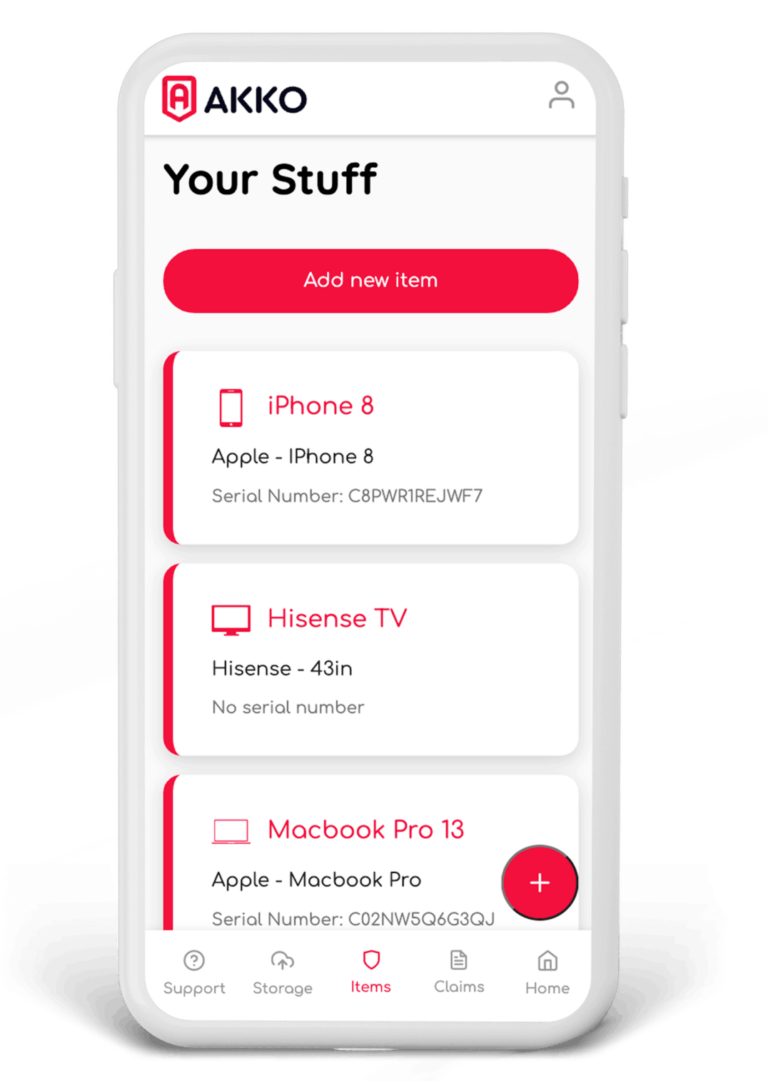

How Do I File A Claim For My Electronics?

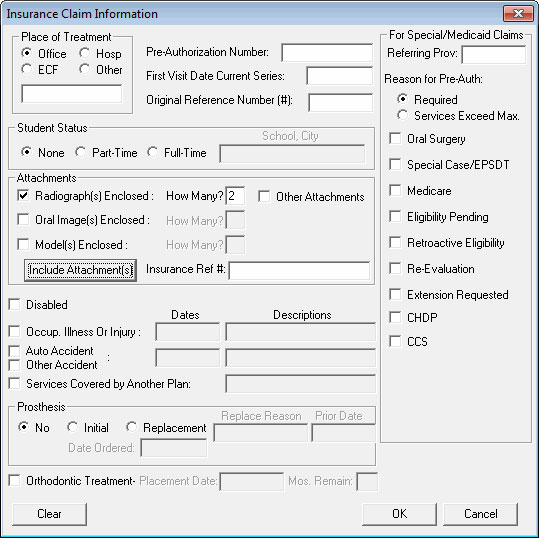

If your electronics are lost, stolen, or damaged, you may be able to file a claim to receive reimbursement. Most electronics are covered by insurance policies, but the process for filing a claim can vary depending on the insurer. You will need to provide documentation of the loss or damage, as well as receipts or other proof of ownership.

To start, contact your insurance company and let them know that you need to file a claim. They will likely have a specific process for you to follow. In most cases, you will need to fill out a claim form and submit it along with any supporting documentation.

Once your claim is processed, you will receive a check or other payment for the value of your lost or damaged electronics.

How Soon Does Coverage Begin After I Purchase An Electronics Insurance Policy?

Purchasing an electronic insurance policy is a great way to protect your expensive devices. But how soon does coverage begin after you purchase the policy? Most insurance policies have a waiting period of days. This means that if your device is lost, stolen, or damaged within days of purchasing the policy, the insurance company will not cover the cost of replacement or repair.

There are some policies that have a shorter waiting period of days, but these tend to be more expensive. So if you can wait days, it will save you some money. Of course, if you do have an accident or your device is lost or stolen within the first few days, you can always purchase a new policy.

Just be sure to check the waiting period before you buy.

What Is The Deductible For An Electronics Insurance Policy?

An insurance deductible is the amount of money that you have to pay out of pocket before your insurance company starts paying for a covered claim. In the insurance world, a “deductible” refers to the portion of an insured loss that the policyholder is responsible for paying. For example, if you have a $deductible on your car insurance policy and you have a car accident that causes $worth of damage to your car, you will pay the first $of the repair bill, and your insurance company will pay the remaining $The amount of the deductible for an electronics insurance policy varies depending on the company and the coverage, but it is typically a percentage of the item’s value. For example, if you have a policy with a deductible and you need to file a claim for a $television, you would pay the first $of the repair bill and the insurance company would pay the remaining $.

How Much Coverage Does An Electronics Insurance Policy Provide?

An electronics insurance policy provides coverage for your electronic devices in the event that they are lost, stolen, or damaged. The amount of coverage you will receive will depend on the policy you purchase, but most policies will cover the full value of your devices. Some policies may also cover additional costs such as the cost of replacement batteries or repairs.

What Is The Best Way To Compare Electronics Insurance Policies?

There are a few things to look for when comparing electronic insurance policies. First, check the coverage limits and make sure they are adequate for your needs. Next, check to see if the policy covers Accidental Damage from Handling (ADH) or Manufacturer’s Defects.

You will also want to find out if there is a deductible and what the claims process is like. Finally, make sure to read the fine print so that you understand what is and is not covered under the policy. When it comes to choosing an electronics insurance policy, it is important to compare policies to find the one that best fits your needs.

By doing your research and understanding what you need to look for, you can be sure to find the right policy for you.

Conclusion

If you are looking for insurance for your electronics, Best Electronics Insurance is a great option. They offer insurance for a variety of electronics, including laptops, smartphones, and tablets. Best Electronics Insurance is a great way to protect your investment and keep your electronics safe.

Leave a Reply