Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt USD967344900 ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

A comprehensive insurance policy for your gadgets against any unforeseen events. Be it, screen breakage, water damage, or any other kind of accidental damage, we’ve got you covered.

If you’ve ever had a phone or laptop break, you know how expensive it can be to get it fixed. Even if you have insurance, the deductibles can be pretty high. So what if there was a way to insure your devices against accidental damage for just a few dollars a month? With Electronics Accidental Damage Insurance, you can get coverage for your devices against drops, spills, cracked screens, and other accidents. For just a few dollars a month, you can have peace of mind knowing that if something happens to your device, you can get it fixed without breaking the bank.

Whether you have an iPhone, Galaxy, or any other type of device, Electronics Accidental Damage Insurance can help you get it fixed if something happens to it. So if you’re looking for a way to protect your devices, consider getting this insurance.

What Is Electronics Accidental Damage Insurance?

Most people have insurance for their homes or car, but what about their electronics? Electronics accidental damage insurance is a type of insurance that covers repairs or replacement costs for your electronic devices if they are damaged in an accident. This can include damage from drops, spills, and electrical surges. If you have a laptop, smartphone, or other electronic devices that you use frequently, it’s a good idea to consider getting insurance for it.

Even if you are careful with your devices, accidents can happen. And if you’re not insured, you’ll have to pay the full cost of repairs or replacement out of pocket. Electronics accidental damage insurance is usually fairly affordable, and it can give you peace of mind knowing that your devices are protected.

Before you purchase a policy, be sure to read the fine print so you know exactly what is and is not covered.

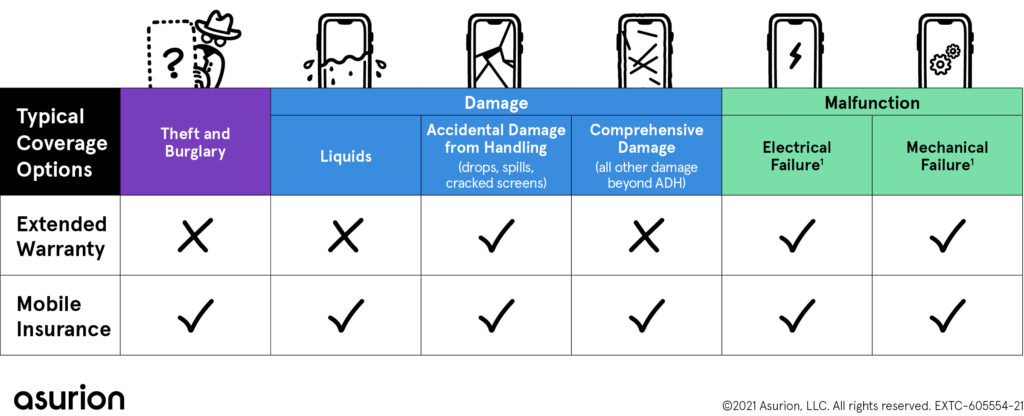

What Does Electronics Accidental Damage Insurance Cover?

Your electronics are important to you and you rely on them every day. Whether it’s your laptop for work, your tablet for entertainment, or your smartphone for communication, when one of them breaks, it can be a major inconvenience. Accidental damage insurance can help protect your electronics from unexpected accidents, like dropping your phone or spilling water on your laptop. It can also give you peace of mind knowing that you’re covered in case of an unexpected mishap.

Most accidental damage insurance policies will cover damage caused by drops, spills, bumps, and electrical surges. Some policies will also cover theft or loss. When shopping for accidental damage insurance, make sure to compare policies to find one that meets your needs and budget. Be sure to read the fine print so you know what is and isn’t covered.

With accidental damage insurance, you can rest assured knowing that your electronics are protected against the unexpected.

How Does Electronics Accidental Damage Insurance Work?

Most electronics are covered by a manufacturer’s warranty, but these typically only last for a year or two. Once your warranty expires, you’re on your own if your device breaks. If you have electronic accidental damage insurance, you’re protected from drops, spills, and other accidents that can damage your devices. This type of insurance is also sometimes called gadget insurance or device insurance.

Here’s how it works: let’s say you accidentally drop your laptop and the screen shatters. If you have electronic accidental damage insurance, you can file a claim with your insurer to have the cost of repairs or replacements covered. Typically, you’ll have to pay a deductible (usually $or $ before your insurance kicks in. And there may be some restrictions on what types of accidents are covered.

For example, plans may not cover intentional damage, like if you throw your phone in anger. If you’re thinking about buying electronics accidental damage insurance, be sure to compare different plans and find one that meets your needs. Some plans only cover certain types of devices, while others have maximum coverage limits. Accidents happen, but with insurance, you can rest easy knowing your devices are protected.

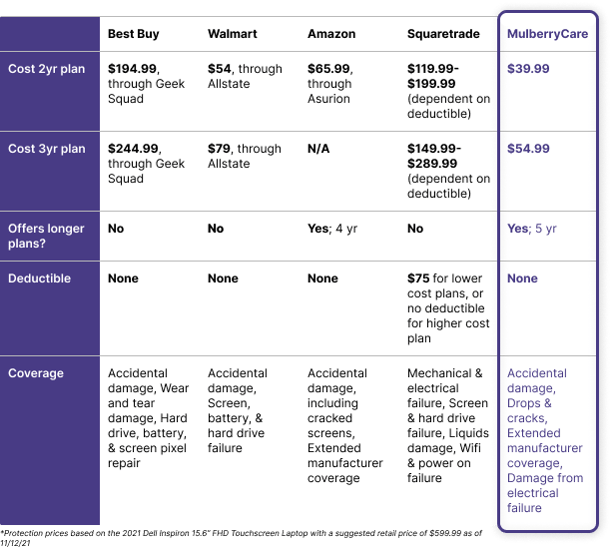

How Much Does Electronics Accidental Damage Insurance Cost?

Accidental damage insurance for electronics can cost as little as $per month or as much as $per month, depending on the type and value of electronics covered and the deductible. For example, a policy with a $deductible covering a $laptop would cost around $per month, while a policy with no deductible covering a $television would cost around $per month.

Is Electronics Accidental Damage Insurance Worth It?

When you buy a new electronic device, you may be offered insurance that covers accidental damage. But is this insurance worth the cost? There are a few things to consider when making this decision. First, what is the likelihood that you will damage your device? If you are careful with your belongings, the chances of an accident are pretty low.

Second, how much would it cost to repair or replace your device if it was damaged? If the cost is relatively low, you may not need insurance. Third, does your home insurance policy cover accidental damage to electronics? If so, you may already be covered. Fourth, what is the deductible on the insurance policy? The deductible is the amount you would have to pay out of pocket if you made a claim.

If the deductible is high, it may not be worth it to get the insurance. In the end, whether or not you get insurance to cover accidental damage to your electronics is a personal decision. Consider the factors above to help you make the best choice for your situation.

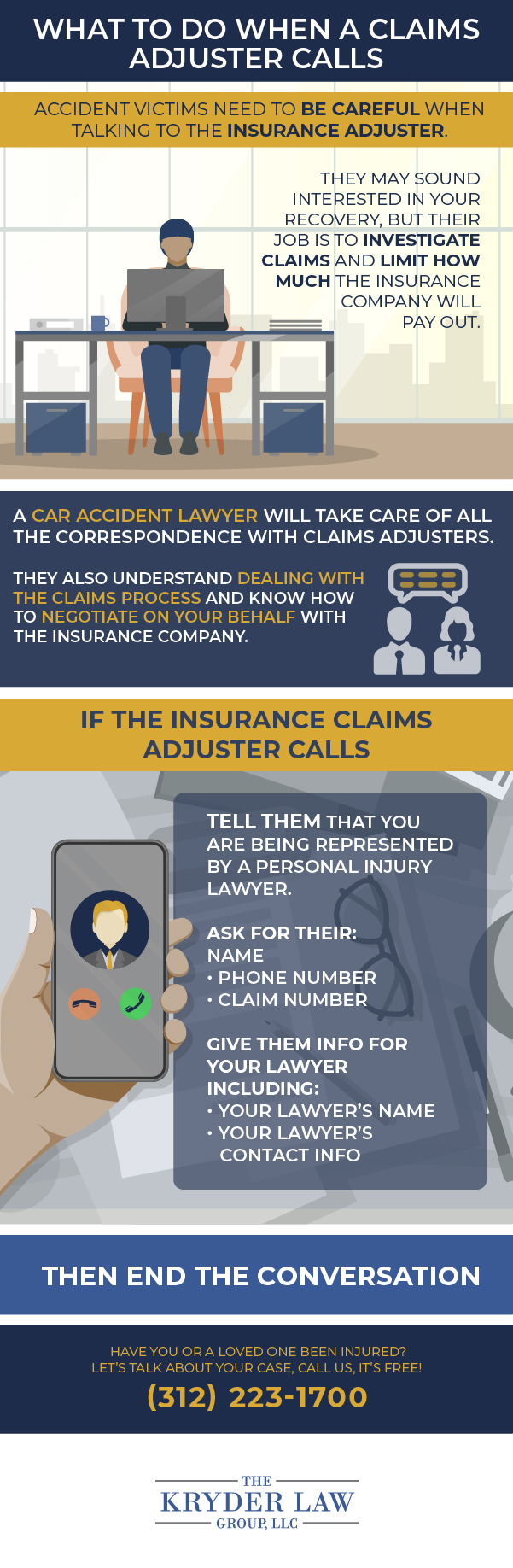

How Do I File A Claim For Electronics Accidental Damage Insurance?

There are a few things you should do if you need to file an insurance claim for accidental damage to your electronics. First, try to find the warranty information for your item. In many cases, accidental damage is not covered under the standard warranty.

However, some manufacturers offer an accidental damage protection plan that you can purchase for an additional fee. If you can’t find the warranty information or if your warranty does not cover accidental damage, the next step is to contact your insurance company. Explain the situation and find out what the process is for filing a claim.

Most insurance companies will require you to submit a police report or other documentation proving that the damage was accidental. Once you have all the required documentation, submit your claim form to the insurance company. Be sure to keep all receipts and other documentation in case the insurance company needs more information.

Once the claim is processed, you will receive a check for the amount of the damages minus any deductible.

What Is The Process For Filing A Claim For Electronics Accidental Damage Insurance?

The insurance company will then likely send out an inspector to assess the damage and determine if it is covered by the policy. If it is, they will provide you with a claims form to fill out and return. Once the form is received, the insurance company will assess the damage and determine the cost of repairs or replacement. If everything is approved, they will send out the payment to cover the costs.

As you can see, the process for filing a claim for electronic accidental damage insurance is not overly complicated. However, it is important to follow the steps correctly in order to ensure a smooth and successful claim process.

How Long Does It Take To Get A Claims Check For Electronics Accidental Damage Insurance?

It can take up to four weeks to receive a claims check for accidental damage insurance, although the process may be quicker if the insurance company can confirm the loss or damage through a third party. The length of time it takes to get a claims check can vary depending on the insurance company, the type of policy, and the amount of the claim.

What Is The Maximum Amount That Can Be Claimed For Electronics Accidental Damage Insurance?

There is no definitive answer to this question as it depends on the insurer and the policy. However, as a general guide, most insurers will cover up to $$for accidental damage to electronics.

How Often Can I File A Claim For Electronics Accidental Damage Insurance?

For most insurance policies, you can file a claim for accidental damage once per year. Some policies may have a higher or lower limit. Check with your insurance company to see what your limit is.

Is There A Deductible For Electronics Accidental Damage Insurance?

Generally, insurance policies have a deductible, which is the amount that the policyholder must pay out of pocket before the insurer will pay a claim. For example, if you have a $deductible and your cell phone is stolen, you would have to pay the first $of the repair or replacement cost. There are a few insurers that do not have a deductible for electronic accidental damage insurance, but they are generally more expensive.

What Is The Best Electronics Accidental Damage Insurance?

There are a lot of different electronic accidental damage insurance policies out there, and it can be tough to decide which one is best for you. Here are a few things to keep in mind when choosing a policy: Make sure the policy covers all of the types of accidents that could happen to your electronics. Consider how much coverage you need. Some policies have limits on how much they will pay out per item, while others have unlimited coverage.

Choose a policy with a deductible that you are comfortable with. Be sure to read the fine print of any policy before you purchase it.

What Are The Benefits Of Electronics Accidental Damage Insurance?

An electronic accidental damage insurance policy can provide coverage for laptops, cell phones, and other portable electronics that may be damaged as a result of an accident. This type of policy can help to protect against costly repairs or replacements that would otherwise need to be paid outfoxed.

Some of the benefits of having electronics accidental damage insurance may include: voiding costly outfoxed repair or replacement expenses coverage for a wide range of accidents, such as drops, spills, and cracked screens flexible coverage options to tailor the policy to your needs each of mind in knowing that your electronic devices are protected.

Conclusion

t is always a good idea to have some form of electronic accidental damage insurance, especially if you are prone to accidents or if your electronics are expensive. there are a variety of different companies that offer this type of insurance, so it is important to do your research to find the best one for you. Make sure to read the fine print of any policy you are considering so that you know exactly what is covered and what is not.

Leave a Reply